Free bonus check

Reward every step of the way。

We are with you every step of the way。

We're making it easier to earn cash back rewards every month。Any debit card transaction will count towards your reward total - including signature and pin transactions。In addition, using your debit card for online purchases and payments also counts。

With free conveniences such as mobile banking and a surcharge free ATM network for depositing checks from your smartphone - and no monthly fees at the same time - this is a checking account that fits your life。

Characteristics and advantages

- 1% cash back on the first $1,000 transaction *。

- Up to $10 refund on ATM fees1

- There is no minimum balance requirement

- There is no monthly service charge

Qualification is easy!

- Make 25 credit card signature, PIN or debit transactions per month

- Receive electronic statements

- Receive a $500 ACH deposit into your Free Rewards checking account

Meaningful examination

1% cash back on the first $1,000 transaction *。

Up to $10 refund on ATM fees1

There is no minimum balance requirement and no monthly service charge

Powerful inspection convenience

With Free reward checks, you will enjoy unlimited check writing and value-added convenience that can help you better manage your money。

No monthly service charge

Or minimum balance requirements

No overdraft charges

Debit card transactions with an overdraft of less than $302

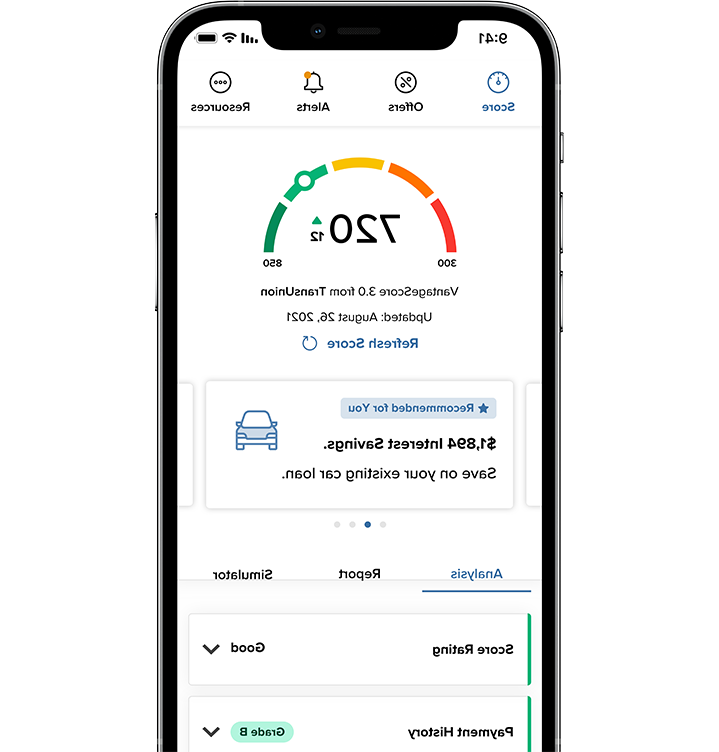

Free mobile banking, let your life do what you want

With mobile deposit, reward tracking and other functions3

Free Visa® debit card

Purchase reminders and card controls can be found in mobile apps and online banking。

Q&A

-

When can I receive my debit card?

邮寄。7-10 business days

Be present at the scene。Instant issue option

-

When do I start earning rewards on my account?

To be eligible to start accumulating trades immediately (starting immediately after opening a checking account or converting from a basic check), rewards are applied to the account at the end of the month。If the checking account is 关闭键d before the end of the month, then the reward will not be applied。Members can use the OLB and the rewards check-in widget in the mobile app to track their progress。

-

What if I overdraw my account?

Overdraft does not affect rewards。

Open account。

- Pay politely

- Overdraft transfer

-

Whether there are any fees or minimum balance requirements?

Free bonus check no。If the requirements are not met, a Courier fee may be charged for the basic check。

-

I'm going to open a checking account。Where should I start?

New member。It can be opened in person at a branch or online。

Existing members。It can be opened in person at a branch, online or over the phone 703.526.0080 x4.

* Cashback is calculated based on the total amount of eligible debit card transactions。The account does not earn dividends。1% cash back on the first $1,000 transaction。The maximum cash back amount is $10。To meet the minimum requirements, transactions must be made during the eligibility period and must be cleared/transferred to the account。From the date of the transaction, it may take one or more banking days for the transaction to be posted and settled in your account。Credit card and signature, password and debit payment transactions must be cleared by the end of the month。Standard fees will apply if the account has been inactive for more than 12 months。

1Up to $10 in ATM fees can be refunded if you meet the reward criteria。

2There are no overdraft or courtesy payment fees for debit card transactions under $30。This only applies to debit card transactions。ACH transactions do not have a $30 grace period before the courtesy payment fee is charged。Courtesy payments must be repaid within 45 days。If the courtesy payment is disabled and the transaction is declined, the courtesy payment fee will not be paid。In these cases, NSF fees will be charged。Courtesy payments include the following types of transactions: checks, ACH and other transactions using checking accounts, automated bill payments, recurring transactions set up using debit cards, ATM transactions, daily debit card transactions, and point-of-sale (POS) transactions。ATM transactions, daily debit card transactions, and point-of-sale (POS) transactions need to be selected separately。

3Data rates may apply。

Membership required。Federal insurance is provided by NCUA。